And here is a chart from Calculated Risk, showing the Dallas price declines in relation to the price declines in other metro areas. (Look for Dallas on far right)

faith * politics * culture * economics * social issues * history : for now we see in a mirror dimly, but then face to face; now I know in part, but then I will know fully

During the great housing boom, homeowners nationwide borrowed a trillion dollars from banks, using the soaring value of their houses as security. Now the money has been spent and struggling borrowers are unable or unwilling to pay it back.

"... the more money you borrowed, the less likely you will have to pay up.

“It rewards immorality, to some extent.”

“Americans seem to believe that anything they can get away with is O.K.”

Many also say that the banks were predatory, or at least indiscriminate, in making loans, and nevertheless were bailed out by the federal government. Finally, they point to their trump card: they say will declare bankruptcy if a settlement is not on favorable terms.

Fewer than 5 percent of these clients said they would continue paying their home equity loan no matter what. ... 85 percent said they would default and worry about the debt only if and when they were forced to.

“It’s come to the point where morality is no longer an issue.”

“I’m kind of banking on there being too many of us for the lenders to pursue,” [a defaulted homeowner] said. “There is strength in numbers.”

(Read the entire article from the NYT here)

Follow the link for more of the car company ownership relationships all around the world.

Follow the link for more of the car company ownership relationships all around the world.

| Worst-Paying College Degrees in 2010 | ||

| College Degree | Starting Pay | Mid-Career Pay |

| 1. Child and Family Studies | $29,500 | $38,400 |

| 2. Elementary Education | $31,600 | $44,400 |

| 3. Social Work | $31,800 | $44,900 |

| 4. Athletic Training | $32,800 | $45,700 |

| 5. Culinary Arts | $35,900 | $50,600 |

| 6. Horticulture | $35,000 | $50,800 |

| 7. Paralegal Studies/Law | $35,100 | $51,300 |

| 8. Theology | $34,700 | $51,300 |

| 9. Recreation & Leisure | $33,300 | $53,200 |

| 10. Special Education | $36,000 | $53,800 |

| 11. Dietetics | $40,400 | $54,200 |

| 12. Religious Studies | $34,700 | $54,400 |

| 13. Art | $33,500 | $54,800 |

| 14. Education | $35,100 | $54,900 |

| 15. Interdisciplinary Studies | $35,600 | $55,700 |

| 16. Interior Design | $34,400 | $56,600 |

| 17. Nutrition | $42,200 | $56,700 |

| 18. Graphic Design | $35,400 | $56,800 |

| 19. Music | $36,700 | $57,000 |

| 20. Art History | $39,400 | $57,100 |

This is from Yahoo Finance.

- more people are moving to Texas than to any other US state

- more Fortune 500 companies are based in Texas than in any other state

- Texas economy would rank as 15th largest in the world, ahead of Australia, Turkey, Argentina

- Texas is the biggest exporting state in the US, exporting 33% more than the next on the list - California

God Bless Texas!

From the Wall Street Journal Photo blog: "Pakistani volunteers carried away the bodies of a pair of Pakistani Christian brothers accused of blasphemy against Islam The brothers were shot to death Monday as they left a court in Faisalabad."

From the Wall Street Journal Photo blog: "Pakistani volunteers carried away the bodies of a pair of Pakistani Christian brothers accused of blasphemy against Islam The brothers were shot to death Monday as they left a court in Faisalabad."“Blessed are those who are persecuted for righteousness' sake, for theirs is the kingdom of heaven.Blessed are you when others revile you and persecute you and utter all kinds of evil against you falsely on my account. Rejoice and be glad, for your reward is great in heaven, for so they persecuted the prophets who were before you."

Britain's sports minister offered to help resolve the tax issues that have caused Olympic champion Usain Bolt to withdraw from the Crystal Palace Diamond League meet.Bolt announced on Monday he would not compete at the August 13-14 event because his earnings in London would be greatly diminished after taxes.

Sports Minister Hugh Robertson told the BBC he'll see what he can do, but said "three weeks doesn't give us a whole lot of time to organize a tax concession."

The British finance ministry has already exempted visiting soccer players from local tax laws to ensure the Champions League final can be staged at Wembley Stadium next year. (From USA Today). More at NY Times economix blog.

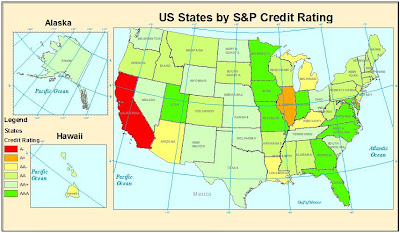

It is great seeing governments compete! Competition is what forces businesses to keep costs low and quality high. Typically governments have not had to compete much, but in the increasingly globalized world athletes like the Champions League soccer players or Usain Bolt can increasingly "shop" among jurisdictions for where to offer their entertainment services. This will put long overdue pressure on jurisdictions to be more people-friendly. US states and cities are also experiencing the same pressures to have competitive tax environments, as illustrated by this story about choices of locations for boxing bouts.

"To see the negative effect of almost any transfer policy on productive effort, consider the reaction of students if a professor announces at the beginning of the term that the grading policy for the class will redistribute the points earned on the exams so that no one will receive less than a C. Under this plan, students who earned A grades by scoring an average of 90 percent or higher on the exams would have to give up enough of their points to bring up the average of those who would otherwise get Ds and Fs. And, of course, the B students would also have to contribute some of their points as well, although not as many, in order to achieve a more equal grade distribution.I'm itching to offer at least one quiz in my economics course this fall on the terms described above, so that the results could be demonstrated to class and effects of redistribution explained!

Does anyone doubt that the students who would have made As and Bs will study less hard when their extra effort is "taxed" to provide benefits to others? And so would the students who would have made Cs and Ds, since the penalty they paid for less effort would be cushioned by point transfers they would lose if they earned more points on their own.

The same logic applies even to those who would have made Fs, although they probably weren't doind very much studying anyway. Predictably, the outcome will be less studying, and overall achievement will decline. The impact of tax-transfer schemes will be similar: less work effort and lower overall income levels."

Enjoy!

Who Owns America's Debt - A Dynamic Perspective on Major Foreign Holders of Treasury Securities (2002-Present) from Computational Legal Studies on Vimeo.